- Dan Morehead, a former Tiger Management executive, founded the $3.5 billion Pantera Capital in 2003.

- He explains why profit opportunities are outside of bitcoin and ethereum in the next few years.

- He also breaks down why now is actually the best time to buy given human nature is pro-cyclical.

For someone who has spent his entire career looking for “very asymmetric trades” where the “upside is way bigger than the downside,” Dan Morehead is betting on bitcoin to be the biggest such trade yet.

“It is going against all of the biggest markets on earth,” Morehead, chief executive and co-chief investment officer of the $3.5 billion crypto hedge fund Pantera Capital, said in a Tuesday call for his new blockchain fund launch.

Morehead, who was the former head of macro trading and chief financial officer at Julian Robertson’s Tiger Management, launched Pantera Capital Management in 2003 where he managed over $1 billion in a global macro strategy for institutional investors. In 2013, the firm launched the first cryptocurrency fund in the US when bitcoin was trading at $65.

His early entry into bitcoin has paid off in the long term. The Pantera Bitcoin Fund, which passively tracks the largest cryptocurrency, is up 48,500% in eight years and 374% since January last year, according to the firm.

But it is the firm's two crypto token funds that generated the most impressive returns. The Pantera Early-Stage Token Fund and Liquid Token Fund are up 1,620% and 1,054% since last January. And Morehead wants to do more in the space as the non-bitcoin-and-ethereum market share rises to 37% now from 16% in January.

"One of our main themes since January has been investing just in bitcoin is not enough," he said. "We think the majority of the profit opportunity over the next three or four years is in the sector that's not bitcoin or ethereum."

16 early-stage and liquid token picks

Morehead said there are 150 tokens that are liquid enough to trade now, and Pantera Capital has taken a two-pronged approach to invest in them.

It labels early-stage tokens as tokens of or rights to future tokens underpinning new protocols.

For example, investments in the firm's early-stage token fund include Acala Network (ACA), NEAR Protocol (NEAR), Ampleforth (AMPL), Flexa (FXC), 0x (ZRX), DODO (DODO), Wintermute, Origin Protocol (OGN), ECO (ECO), and Polkadot (DOT).

Meanwhile, liquid tokens are liquid assets spanning various functions like store of value, decentralized finance, and adjacent crypto assets. Top investments in the liquid token fund include Ethereum (ETH), Terra (LUNA), Maker (MKR), Compound (COMP), Aave (AAVE), and Uniswap (UNI).

Why now is the best time to buy

Cryptocurrencies have lost over $1 trillion in total market cap since reaching a peak of over $2.47 trillion in May, but Morehead believes that now is actually the best time for those with the financial and emotional resources to buy.

To start with, he said there has been an "astronomical" amount of money printed in the US since the onset of the Covid-19 pandemic, with more money being printed each month than in the first 200 years of the country's existence.

Under similar macroeconomic circumstances in the 1970s, legendary investors such as Paul Tudor Jones and Stanley Druckenmiller bought a lot of gold. This time, they turned to bitcoin, which has a compound annual growth rate of 233% over the past 11 years and just a 0.08 correlation with the major asset classes of the world, according to Morehead.

He also sees blockchain technology disrupt the status quo of the financial services industry, which remains untouched by the internet and software. That massive opportunity set has driven mainstream banks and companies such as JPMorgan, Morgan Stanley, PayPal, and Square to adopt cryptocurrencies.

A veteran macro and crypto investor, Morehead believes that human nature is procyclical, which means investors tend to follow the herd to buy high and sell low.

"When markets are screaming up and are at their all-time highs, the FOMO devil is whispering in our ear," he said. "And then when they're crashing and down like they are right now, it doesn't feel very fun to buy them... but that's actually the best time to buy."

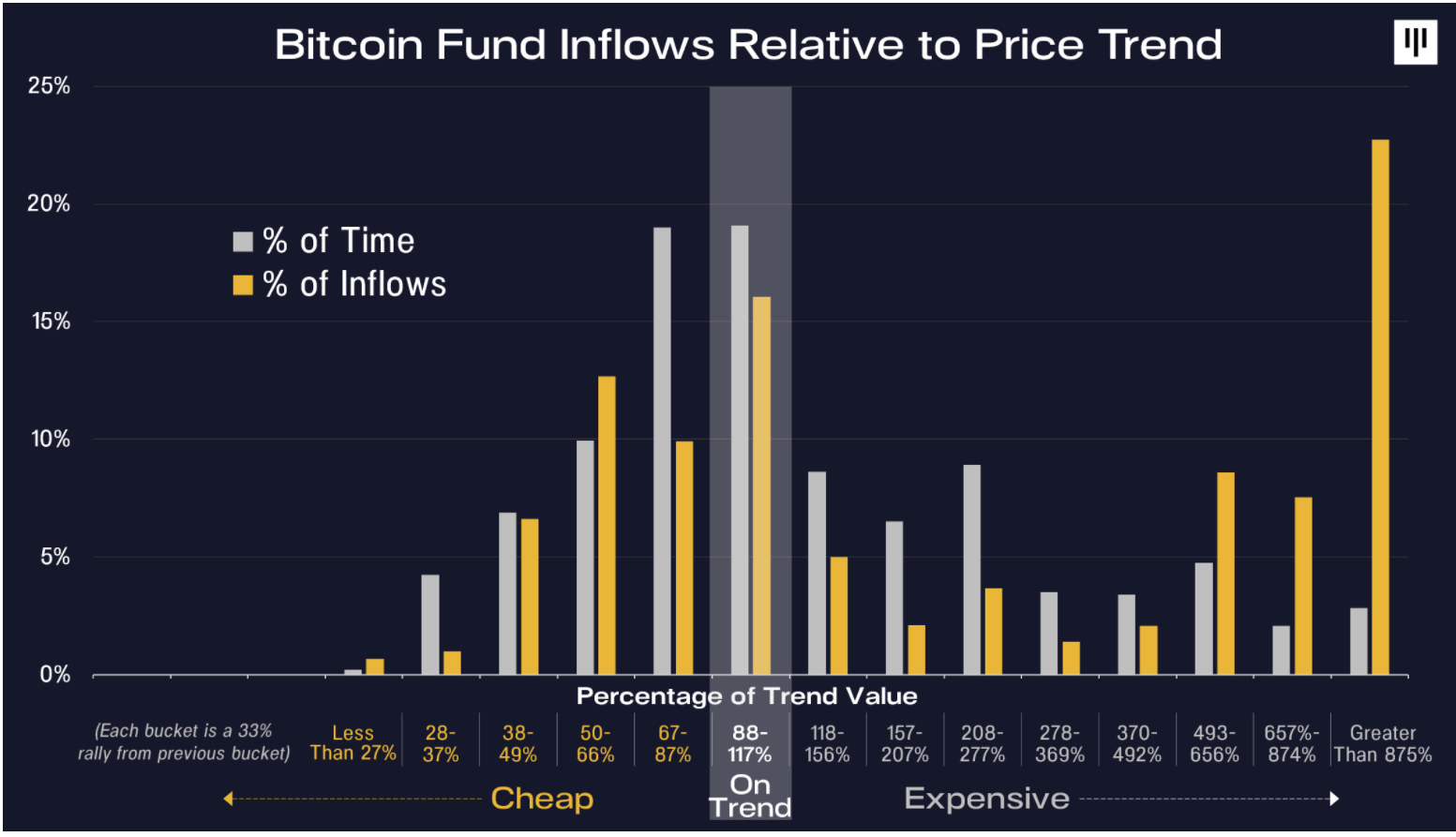

He used the histogram below, which illustrates the inflows into the firm's bitcoin fund over the last eight years, to show the procyclical trend.

"The flows into the fund, though have been very procyclical, not very many people investing when it was really really cheap; like right now, it's 46% cheap, which only 5% or 8% of people have invested below this level," he said. "But then when it's way above its long-term trend is when most people have come into the fund, so I just want to encourage people who have the financial and emotional resources to get engaged when it's cheap to the markets."